Agent banking expands with growing concentration in Dhaka, Chattogram

Daily Sun Report, Dhaka

Published: 10 Nov 2024

Like general banks, agent banking services are now increasingly concentrated in two major divisions - Dhaka and Chattogram.

Banks tend to prioritise these two regions, as they are the largest sources of deposits and loans.

Similarly, agent banking services, initially intended to extend financial inclusion to underserved areas, are also becoming heavily concentrated in these divisions.

The presence of agent banking booths has also significantly increased in Dhaka and Chattogram cities - two major urban centres of the country.

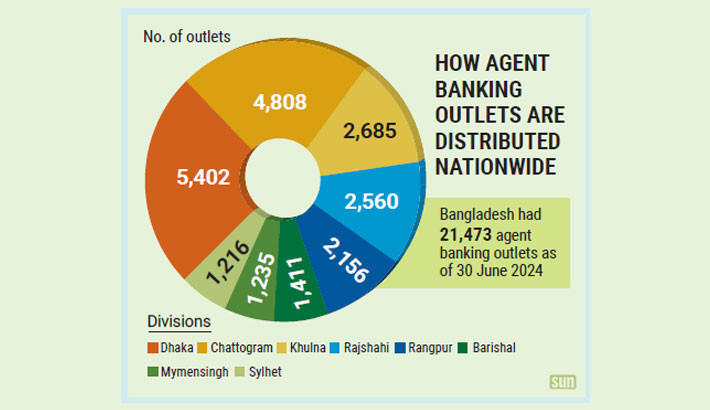

According to the latest Quarterly Report on Agent Banking Statistics by Bangladesh Bank (BB), banks operated a total of 21,473 agent outlets at the end of June 2024.

Of these, 3,100 were located in urban areas, while 18,373 served rural communities.

Dhaka division alone hosted 5,402 agent outlets, with Chattogram following closely at 4,808.

The Khulna division had 2,685 outlets, Rajshahi had 2,560, and Rangpur had 2,156. Barishal, Mymensingh, and Sylhet divisions had 1,411, 1,235, and 1,216 outlets, respectively.

Bank officials attribute this concentration to the greater financial resources available in Dhaka and Chattogram, making these areas a natural focus for banking expansion.

Potential agents in these divisions also show higher interest in this business, which contributes to the concentration of outlets.

Currently, 31 banks, including two state-owned, 21 private commercial, and eight Islamic banks, offer agent banking services across Bangladesh. By the end of June 2024, these services were provided through 21,473 outlets operated by 15,991 agents, marking a 3.09% increase in agent numbers compared to June 2023.

Deposits surge

Agent banking deposits saw a notable year-on-year increase of 22.34%, reaching Tk39,814 crore by June 2024, up from Tk32,543 crore in June 2023.

Meanwhile, outstanding loans under agent banking reached Tk9,150 crore, highlighting a growing reliance on credit among individuals and businesses. This rise in both deposits and loans underscores the increasing popularity of agent banking across the country.

Private commercial banks dominate the agent banking sector with 11,274 agents, representing 70.5% of all agents. Islamic banks follow with 3,941 agents, or 24.65%, while state-owned banks have a smaller footprint, accounting for just 4.85% of agents with 776 outlets.

Rise in female participation

As of June 2024, agent banking data shows that male accounts make up 48.78% of deposit accounts, while female accounts represent 49.67%.

According to Bangladesh Bank, the notable rise in female accounts underscores an increased participation of women in the formal financial system, a key factor in advancing financial inclusion.

Female deposit accounts in agent banking grew by 16.58% compared to June 2023, with female loan accounts also rising by 17.31% year-over-year.

Agent banking extends traditional banking services to underserved populations in remote areas of Bangladesh, offering a cost-effective alternative to standard bank branches. Introduced by Bangladesh Bank in 2013, agent banking enables customers to access a variety of banking services.

The first agent banking outlet was launched by Bank Asia PLC in December 2013, at the Joyinshar Union, Serajdikhan, Munshiganj.