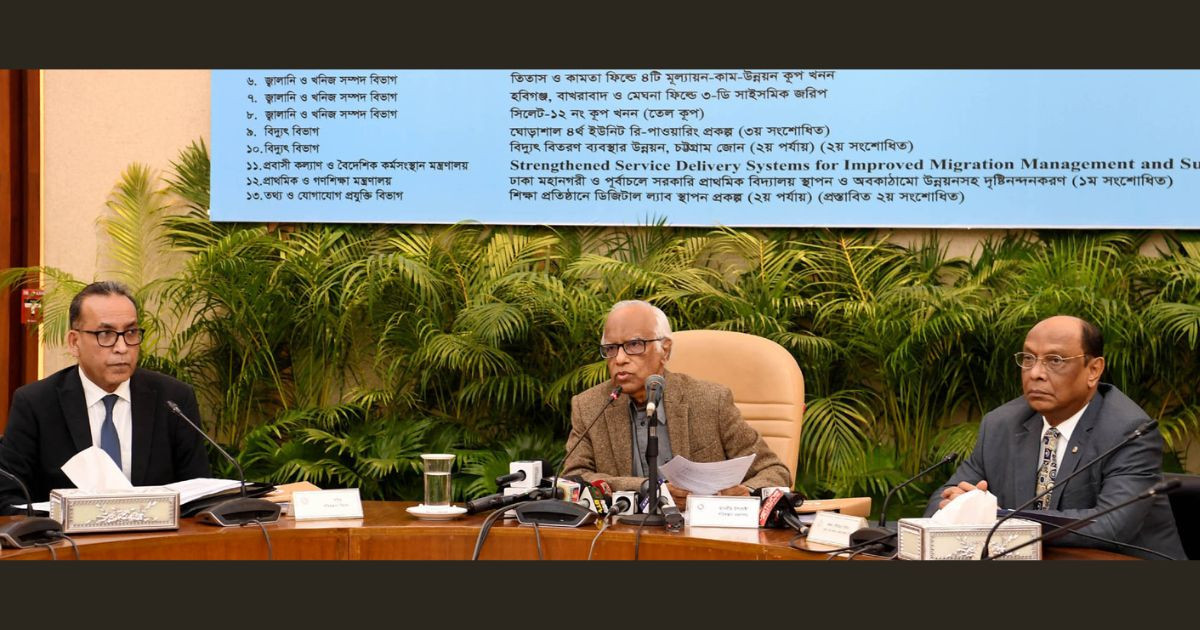

Photo: PID

Planning Adviser Dr Wahiduddin Mahmud has said the country is expected to witness a significant change in budget management with foreign loans taking centre stage in financing development projects.

This year, foreign financing will make up a larger portion of the development budget (Annual Development Programme) compared to domestic funding, he said during a briefing after a meeting of the Executive Committee of the National Economic Council (ECNEC) on Sunday.

The ECNEC meeting, chaired by Chief Adviser Prof Muhammad Yunus, was held at the NEC Conference Room in Sher-e-Bangla Nagar.

Wahiduddin Mahmud, also the education adviser, said foreign loans will account for approximately 60% of the development budget, while domestic funding will make up 40%.

This shift is a result of stagnation in revenue collection, although efforts will be made to increase the revenue, he said.

The adviser further said Chinese contractors have become millionaires overnight, and efforts are underway to change that situation.

Regarding a Chinese-funded project at the Mongla Port, he stated that they have reviewed the loan conditions and contractor selection process to ensure there were no weaknesses or irregularities.

Wahiduddin Mahmud confirmed that no issues were found and the project was approved due to its importance. The project was initiated by the previous government.

He added that despite taking on more foreign loans, efforts will be made to utilise those in productive sectors. The loans will primarily be allocated to export-oriented industries.

The planning adviser emphasised that the ongoing projects will continue, though spending on infrastructure will be reduced in favour of human resources development.

For example, medical colleges and various universities are seeing infrastructure development, but there is a shortage of necessary equipment and qualified teachers.

Technical institutions also face a lack of skilled teachers, with 80% of teaching positions vacant. Therefore, efforts will focus on developing skilled human resources.

In response to a question, Wahiduddin Mahmud said the mega projects initiated by the previous government have increased the pressure on paying foreign loan interest, starting from this fiscal year.

In the coming years, principal repayments will significantly rise. However, he clarified that foreign loans are not necessarily detrimental.

The adviser cited Vietnam, which took on a substantial amount of foreign debt but did not face major issues.

He stated that if foreign loans help generate both public and private sector investments, they can be beneficial.