Confidence returns to banks as deposits rise

January saw highest growth in 4 months, indicating a resurgence in public confidence

Mousumi Islam, Dhaka

Published: 13 Mar 2025

In a significant development for Bangladesh’s banking sector, deposits have experienced a notable increase, marking a positive trend after a period of uncertainty.

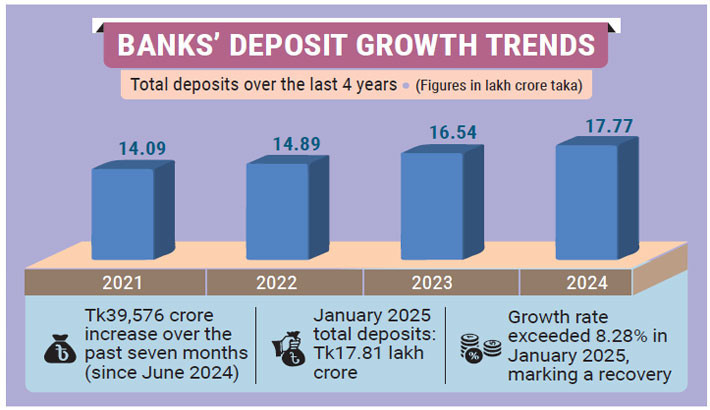

According to recent data, deposits in the banking sector grew by Tk39,576 crore over the past seven months since June 2024, when the total deposits were recorded at Tk17,42,224 crore.

As of January 2025, the banking sector’s total deposits had reached Tk17,81,287 crore, up from Tk16,45,047 crore during the same period the previous year. This represents a growth rate of 8.28%, the highest in four months, indicating a resurgence of public confidence.

However, growth in deposits in the banking sector has shown a declining trend since September of the current fiscal year, falling to 7.26% that month.

It increased slightly to 7.28% in October. It rose slightly further to 7.46% in November and stood at 7.44% in December.

The slight improvement in January, with deposit growth exceeding 8%, marks a significant recovery for the sector.

The central bank reported a 9.50% growth in bank deposits in August, the month the Awami League government fell, despite widespread violence and unrest. Before that, the last time deposit growth fell below 10% was in October 2023, when it was recorded at 9.80%.

High interest rates on deposits

According to BB data, time deposits are the main source of fund collection for the country’s banks. 88% of the total deposits in the banking sector are time deposits.

As of January, Tk18,8985 crore was in demand deposits. The remaining Tk15,92,301 crore was in various deposits.

A contributing factor to the increase in deposits has been the recent rise in interest rates offered by banks, which has made time deposits more attractive to customers.

Some banks are now offering interest rates as high as 12% on time deposits, a rate not seen in recent years. In recent times, banks have been offering higher interest rates on short-term deposits, especially those with durations of less than a year.

The data revealed that private banks currently offer the highest interest rates on fixed deposits.

The average interest rate for fixed deposits with a maturity of less than one year is 9.69%. For fixed deposits with terms exceeding one year, including Deposit Pension Schemes (DPS), the average interest rate is 9.60%.

State-owned banks offer comparatively lower interest rates on fixed deposits. For a one-year fixed deposit, the average interest rate is 8.84%. For fixed deposits with a term of more than one year, including DPS, the average interest rate is 8.69%.

For fixed deposits with a term of less than one year and for longer-term fixed deposits and DPS, specialised banks offer an average interest rate of 7.93%.

Foreign-owned banks in Bangladesh generally offer the lowest interest rates on fixed deposits. For fixed deposits with a maturity of less than one year, the average interest rate is 7.06%, while for those with a term of more than one year, the rate further drops to 5.94%.

Expert opinion on the sector’s recovery

Dr Zahid Hossain, former lead economist at the World Bank’s Dhaka office, explained the situation, highlighting the negative impacts of high inflation, political instability, and changes in the banking sector on deposit growth.

He told the Daily Sun that despite recent improvements in deposits, the banking sector continues to face challenges, primarily due to a loss of public trust caused by corruption and irregularities.

Many people withdrew their money due to inflation and political instability. However, initiatives by Bangladesh Bank have started to rebuild public confidence, resulting in a gradual increase in deposits.

While deposit growth remains constrained by ongoing financial pressures on households, the situation is improving.

He further stressed the importance of a stable investment environment for fostering long-term economic growth. If deposits do not increase, investments will not grow, which will, in turn, lead to stagnation in employment, income, and savings. Thus, the recovery of the banking sector is crucial for addressing the broader economic challenges.

Syed Mahbubur Rahman, the managing director of Mutual Trust Bank, also emphasised the challenges faced by the banking sector in recent years.

He pointed out that the global economic crises in 2022 and 2023, along with the political instability in 2024, had a negative impact on deposits.

He also cited high inflation, the sale of foreign reserves, and concerns about the financial stability of some banks as factors that eroded public confidence.

However, Rahman remained optimistic, stating that with the initiatives taken by the current governor of Bangladesh Bank and the rise in interest rates, customer confidence is improving, and bank deposits are gradually increasing. He expressed hope that this positive trend will continue in the coming months.