Analysis

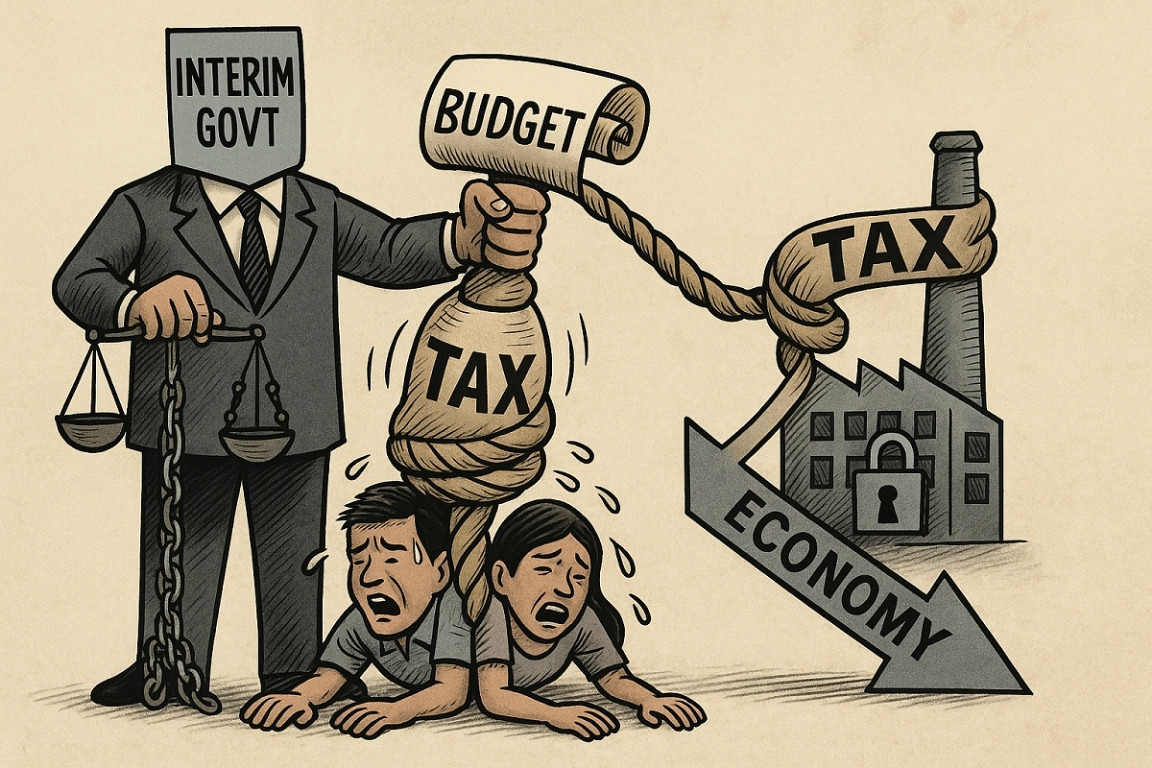

Interim Govt Budget: squeezing the people, choking the future

The proposed budget 2025-26 is a case of austerity without accountability and policies imposed without a public mandate.

Daily Sun Online

Published: 02 Jun 2025

- Illustration generated using AI

The national budget for FY2025–26, presented by the interim regime, lands not as a lifeline but as a burden— tightening the grip on an already breathless nation. In a time of economic fragility and political uncertainty, the document appears less like a vision for recovery and more like a fiscal straightjacket imposed on both people and businesses.

Yes, there are a few bright spots—but they flicker weakly against a backdrop of sweeping austerity. VAT exemptions on select essentials like LNG, sanitary products, liquid milk, and computer hardware offer minimal relief. Healthcare support, through extended VAT exemptions on critical equipment and pharmaceutical ingredients, is long overdue and welcome. There are modest efforts to ease the burdens on agriculture and internet services. But these are isolated, insufficient patches on a much larger wound.

The broader impact of the budget, however, paints a bleaker picture. Across the board, VAT has been increased on household goods, cotton yarn, construction services, and other basics—raising costs for consumers already suffocating under the weight of inflation. The e-commerce sector, once considered a gateway to digital transformation and youth employment, now faces tripled VAT on sales commissions—an inexplicable blow to an industry vital to Bangladesh’s future competitiveness.

This budget was not designed to revive the economy—it was crafted to extract from it. And it does so without the consent of the people

Small and medium enterprises (SMEs), the lifeblood of the economy, are hit particularly hard. The extension of VAT refund periods from four to six months will choke their cash flow, compounding their post-pandemic struggles. The lack of meaningful corporate tax relief or reform signals an alarming indifference to private sector distress. At a time when the economy needs oxygen, this budget chooses to tighten the belt—around its neck.

Compliance measures have also become heavier. The push for digitized tax filing and rigid transaction reporting might sound modern on paper, but for many struggling businesses, it adds another layer of bureaucratic burden. Instead of fostering trust, the system seems designed to trap.

And then there’s the elephant in the room: legitimacy. This sweeping fiscal overhaul is being imposed by a non-elected interim government—one that lacks the public mandate to introduce such wide-reaching economic policies. Interim governments, by convention and necessity, are caretakers—not reformers. Yet this regime, installed amid political upheaval, has chosen to exercise powers that even elected governments have often used cautiously.

The result? A budget that not only fails to heal, but deepens the wound. It offers no vision of growth, no plan for recovery, no path to equity. It promises higher prices for the public, tighter margins for businesses, and zero accountability from those drafting the policies. The interim regime has, in effect, taxed the people without representation—an act of fiscal overreach that should concern every citizen.

Bangladesh today needs more than spreadsheets and press briefings. It needs a legitimate government, chosen by its people, with the authority and trust to implement real reforms. This budget, by contrast, serves as a cautionary tale of what happens when policy is decoupled from public will.

To reclaim economic momentum—and public confidence—there is only one way forward: free, fair, and inclusive elections by December.

Until then, the budget for FY2025–26 will stand not as a charter of progress, but as a symbol of how disconnected governance can fail the nation.