iPhone 17 launches globally, but Bangladesh still awaits official access

High import duties and lack of a local Apple ecosystem leave Bangladeshi fans dependent on resellers and grey-market imports, paying more for limited support

Suman Saha, Dhaka

Published: 15 Sep 2025

Apple has officially announced the iPhone 17 series, which will launch globally on 19 September, with pre-orders already open. The new lineup features the powerful A19 chip, a brighter ProMotion display, upgraded 48MP Fusion cameras, and a new ultra-thin model called the “iPhone Air.”

While the world eagerly awaits the new devices, Bangladesh remains outside Apple’s official network. Consumers here must rely on resellers or overseas purchases, facing higher costs and limited access to official services.

“Apple's popularity is booming in Bangladesh, but the full Apple experience still feels out of reach. Despite rising demand, the tech giant has yet to officially enter the market, leaving users reliant on resellers, workarounds, and higher price tags,” said MN Nahid, a tech industry analyst with nearly a decade of experience.

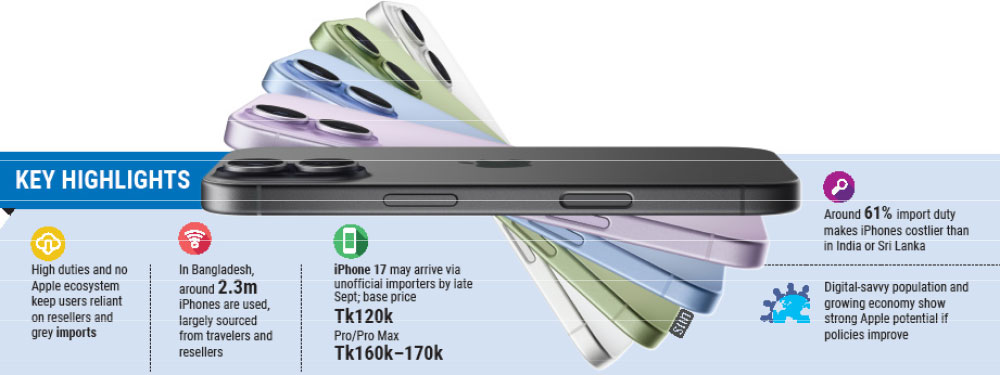

Industry analysts expect the iPhone 17 series to reach Bangladesh through unofficial importers by late September.

The base 256GB model may be priced around Tk120,000, while the Pro and Pro Max variants could cost Tk160,000-Tk170,000 initially. Prices typically drop by Tk10,000-Tk15,000 after the first few weeks.

A handful of “authorised resellers” are expected to bring the phones locally by late October. However, these outlets often charge premiums of Tk50,000–Tk80,000, and questions remain about their actual authorisation status.

Industry insiders estimate that about 2.3 million of the nearly 70 million smartphones in use nationwide are iPhones. Most come through two channels: brought by returning travellers or imported by local resellers through the grey market.

“With every new iPhone launch, Apple fans in Bangladesh grow more eager, yet the absence of an official Apple presence keeps creating gaps in experience, price, and trust,” Nahid added.

At present, there are only three authorised service centres in the country, offering limited support. No official Apple Store exists yet.

For a market as promising as Bangladesh, Apple’s official entry could unlock massive value for users, retailers, and the broader digital ecosystem.

Mixed reviews for the lineup

Globally, reactions to the iPhone 17 series have been muted compared to past launches. Wahidur Rahman, a leading Bangladeshi tech content creator, says: “Apple has been bringing only slight upgrades in recent years, which has reduced global interest. The iPhone 17 series is no exception. The only major addition is a thinner version called the iPhone Air.”

The launch also triggered a market backlash, erasing more than $112 billion from Apple’s market value within just two days of the official announcement. While the base model has minor spec upgrades, the Pro variant has drawn criticism for its design. Many tech enthusiasts have called it the ugliest iPhone Apple has ever made, with a camera housing that now covers almost the entire top portion of the device, giving it an awkward appearance.

Despite these design controversies, the iPhone 17 series includes meaningful improvements: upgraded Center Stage cameras, powerful A19 chips, a 120Hz ProMotion display with up to 3,000 nits of brightness, longer battery life, and enhanced wireless performance with the new N1 chip. “These practical upgrades make the iPhone 17 a solid, if not revolutionary, update,” said Wahidur Rahman, founder of the YouTube channel Tech to the Point.

Bloomberg earlier reported that Apple is working on a three-year roadmap to redesign the iPhone. It's still unclear whether the transformation began with the iPhone 17 - or if the real visual overhaul is being saved for the iPhone 18 series.

Why Apple stays away from Bangladesh

One of the key reasons Apple has yet to establish an official presence in Bangladesh is the high cost of importing smartphones. With import duties hovering around 61%, Apple devices become significantly more expensive than in neighbouring countries like India or Sri Lanka. This makes premium products like the iPhone less accessible to a large portion of potential consumers, reducing the commercial viability of an official launch.

The lack of a localised ecosystem further complicates matters. Essential Apple services, such as creating official Apple IDs, accessing iCloud, using Apple Pay, or subscribing to certain region-specific apps and services, remain limited or unavailable. Without these services, consumers cannot fully experience the Apple ecosystem, and the company risks customer dissatisfaction even if devices are available locally.

Apple’s recent expansion in India offers a glimpse of the conditions it requires to invest. India now has local manufacturing facilities, official Apple Stores, authorised service centres, and a growing digital ecosystem that supports services like Apple Pay and iCloud. This combination of supportive policy, infrastructure, and market readiness has allowed Apple to grow rapidly in a South Asian market, proving that the company is open to investing when conditions align.

The hope for Bangladesh

Bangladesh, with its digitally savvy population, rising smartphone penetration, and steadily growing economy, has strong potential for Apple.

Analysts suggest that if government policies around import duties, taxation, and intellectual property protection improve, and if the country’s banking and digital payment infrastructure becomes more robust, Apple could consider an official entry.

Until then, Bangladeshi consumers will have to continue relying on resellers, grey-market imports, and workarounds to access Apple devices and services. This often means paying higher prices for limited support, but it also reflects the strong demand and loyalty of Apple fans in the country. For now, Apple watchers and local consumers alike hold out hope for a future where the brand officially launches, bringing full access, services, and better pricing.