Regional loan gap widens as Dhaka, Ctg dominate lending

Mousumi Islam, Dhaka

Published: 23 Sep 2025

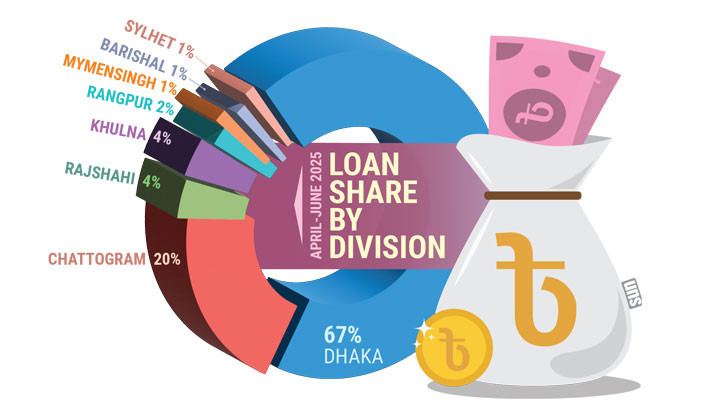

Bangladesh Bank’s latest data highlight widening regional dispari-ties in credit allocation, with most bank loans still concentrated in Dhaka and Chattogram.

With Dhaka alone accounting for over two-thirds of total loans and rural areas receiving only a fraction, the data underscores the grow-ing gap in financial access between urban and rural regions.

Analysis of BB data shows that 86.84% of total bank loans are con-centrated in Dhaka and Chattogram, with Dhaka alone accounting for 67.41% of loans and advances.

Urban areas in Dhaka account for 65.04% of the share, while rural regions receive just 2.37%, highlighting a stark gap in credit acces-sibility.

Chattogram also draws a substantial share of loans, driven by its industrial zones and port-centred businesses.

Economists say this concentration reflects the central role of major cities in Bangladesh’s economic activity.

Dhaka, as the country’s primary commercial and industrial hub, drives high demand for loans in trade, IT, and service sectors, while Chattogram’s industrial and port activities sustain comparatively higher lending in the region.

Meanwhile, peripheral and regional towns struggle with limited cred-it access, hindering local initiatives, SMEs, and agricultural devel-opment.

Data for the April-June 2025 quarter shows that banks’ loans and advances rose by Tk21,553 crore, or 1.26%, reaching Tk1.73 lakh crore.

This growth is slower than the previous quarter (January-March 2025), which saw an increase of Tk29,741 crore, or 1.77%.

In urban areas, loans grew by Tk27,494.49 crore, while rural areas saw a decline of Tk5,940.55 crore, or 4.35%, during the same period.

Division-wise data revealed that Dhaka accounted for the largest share of loans and advances at Tk1.17 lakh crore.

Chattogram’s loans rose 3.85% to Tk3.37 lakh crore, Khulna by 2.13% to Tk64,560 crore, Sylhet by 2.55% to Tk18,171 crore, Barishal by 0.29% to Tk18,815 crore, Rajshahi by 0.50% to Tk64,790 crore, Mymensingh by 0.69% to Tk21,711 crore, and Rangpur by 2.54% to Tk40,111 crore.

Speaking to the Daily Sun, former World Bank lead economist Dr Zahid Hussain warned that the continued concentration of credit in just two divisions could stifle economic growth in other regions.

He said that without adequate loan flow to businesses, industries, and agriculture in other regions, balanced national development is unlikely, and regional disparities could widen over time.

Mustafa K Mujeri, executive director of the Institute for Inclusive Fi-nance and Development and former Bangladesh Bank chief econ-omist, emphasised the need for diversified lending policies.

He told the Daily Sun that banks should extend credit beyond major cities to small and medium towns, supporting local production, trade, employment, agriculture, and small enterprises for balanced national development.

The central bank officials emphasised that new policies and initia-tives are being developed to ensure a more equitable distribution of bank loans nationwide.

(The reporter can be reached at [email protected])