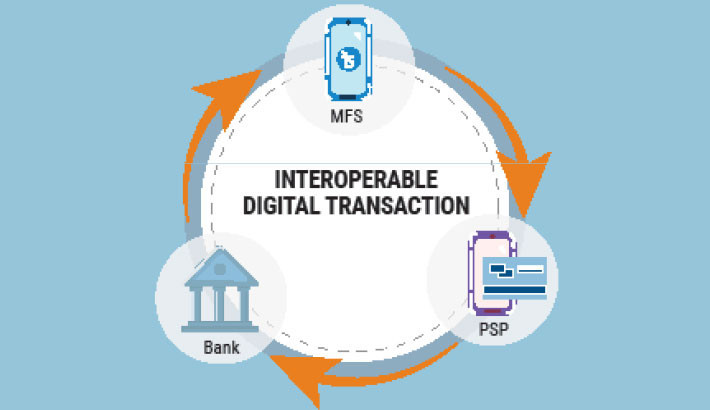

In a bid to build a cashless economy, the Bangladesh Bank (BB) has announced that interoperable fund transfers among banks, mobile financial services (MFS), and payment service providers (PSPs) will officially begin on 1 November 2025.

The move aims to reduce reliance on cash and build a seamless digital payment ecosystem, enabling users to transfer money across platforms such as bKash, Nagad, and Rocket, as well as between MFS wallets and traditional bank accounts.

The central bank’s Payment Systems Department issued a circular on Sunday directing all banks, MFS operators, and PSPs to make the interoperable services operational from the start of next month.

Bangladesh’s digital finance journey began over a decade ago with the introduction of MFS, but the platforms largely operated in isolation, offering limited fund transfers between banks and MFS accounts.

Direct transfers between MFS providers such as bKash and Nagad were not previously possible.

Industry experts have long pushed for interoperability, arguing that it would enhance competition, efficiency, and user convenience while reducing dependency on physical cash.

With this launch, the central bank aims to achieve full integration through the National Payment Switch Bangladesh (NPSB).

How it will work

From November 1, customers will be able to send and receive money seamlessly between: any bank and any MFS account, one MFS provider and another (e.g., bKash to Nagad), and payment service providers (PSPs) such as Upay or SureCash

All transactions will be routed through the NPSB platform to ensure speed, security, and uniformity.

The circular capped transaction fees, including VAT, at 0.15% for banks, 0.20% for PSPs, and 0.85% for MFS providers.

Service providers must display the applicable charge before processing, and only senders may be charged, receivers cannot be.

Existing transaction limits for each account type will remain unchanged.

The Bangladesh Bank expects that interoperable digital transactions will cut cash usage, expand financial inclusion, and make the payment ecosystem more efficient.

Analysts say the initiative will not only benefit individual users but also help small businesses, freelancers, and e-commerce operators by offering faster, cheaper, and more flexible payment options.