Bank merger a costly gamble?

Forced union of weak banks risks wasting public money if core problems are not fixed, warn economists

Mousumi Islam, Dhaka

Published: 24 Aug 2025

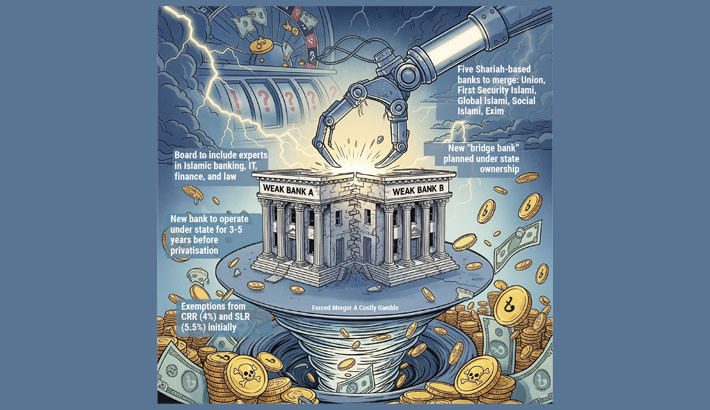

Bangladesh Bank is close to finalising the merger of five struggling Shariah-based private banks into a single “bridge bank”.

However, economists have warned that the move could backfire, arguing that a forced union risks wasting public money unless the root causes of bad loans, poor governance and weak management are addressed.

According to Bangladesh Bank estimates, the merger – involving Union Bank, First Security Islami Bank, Global Islami Bank, Social Islami Bank and Exim Bank – will require about Tk35,000 crore. Of this, Tk20,000 crore is expected from the government as capital injection, Tk8,000-10,000 crore from the Deposit Insurance Trust Fund, with the remainder to be mobilised from development partners. Experts, however, warn that raising these funds will be challenging.

By comparison, just Tk13,000 crore was allocated in the national budget for bank restructuring, making the demand for Tk20,000 crore for only these five banks a matter of concern even within government circles.

A senior Bangladesh Bank official acknowledged that arranging the required financing will be challenging.

Using resources from the Deposit Insurance Trust Fund would require amendments to the Bank Deposit Insurance Act, and it remains unclear how feasible this would be within the time frame. At present, the law stipulates: “Apart from paying depositors of liquidated banks and covering fund maintenance costs as per Section 7, the fund shall not be used for any other purpose.”

Dr Zahid Hossain, former lead economist of the World Bank’s Dhaka office, told the Daily Sun that if the government takes over the banks, it must first address their capital shortfalls. It must also decide whether state financing will be provided in the form of loans or equity.

He explained, “Board formation and management appointments are also crucial. The new board will be responsible for hiring the managing director and other staff, as well as implementing the reform programme. The government may provide financing, but the board must ensure effective execution based on the plan. In other words, the government will take ownership, but efficient and competent leadership is needed to run daily operations.

“Without that, even with government financing, the entire plan risks failure. Especially if capital adequacy, liquidity, and non-performing loan management are not properly handled, depositors’ trust will erode.”

Dr Mustafiz K Mujeri, former chief economist of Bangladesh Bank and executive director of the Institute for Inclusive Finance and Development (INM), was more blunt in his assessment.

He told the Daily Sun, “A merger can only be effective when every participating bank believes it is beneficial for them. But what we see is Bangladesh Bank forcing five banks into a merger, where not all of them are willing. Forcing a merger will never yield positive results. Simply merging five or ten weak banks will not automatically create a strong one.

“Unless the root causes of the banks’ problems are addressed, even merging 50 banks won’t help. Core problems must be resolved, necessary reforms taken, and those reforms must be implemented properly.”

He cited the case of Oriental Bank (now ICB Islamic Bank), which was restructured years ago but remains in distress, with about 80% of its loans still non-performing.

On government financing, he cautioned that without a sound plan, the merger could simply waste public funds.

He stressed that state support must be realistic, carefully designed, and based on the voluntary participation of the banks concerned.

Crisis of depositor confidence

Bangladesh Bank Governor Ahsan H Mansur first announced the merger plan in February. In June, the central bank met with the chairmen and managing directors of the banks, initially stating that the process would begin in July. The timeline has since shifted to October.

The drawn-out announcement has unnerved employees of the affected banks. Some have already been laid off, with further redundancies feared.

At the same time, depositors have begun withdrawing their funds.

Several banks have had to borrow from Bangladesh Bank to meet withdrawals, while others admitted that cash-out pressures have surged since the merger was made public.

Although five banks were initially named in the plan, Exim Bank has since indicated its preference to remain independent.

Recently, the governor met with the chairmen of the remaining four banks involved, leaving Exim out of discussions.

Exim Bank Chairman Nazrul Islam Swapan told journalists that depositors had withdrawn around Tk3,000 crore over the past six months.

“Any bank will be under pressure if the withdrawal demand suddenly rises,” he said, adding that the banks have had to seek special loans from the central bank to cope.

According to Bangladesh Bank figures, the five institutions together serve over 9.2 million customers and employ more than 15,000 people, many of whom now face an uncertain future.

As of May, deposits in the five banks had fallen to Tk1,36,546 crore, down from Tk1,58,606 crore in September last year. In contrast, loans rose to Tk1,95,413 crore. Non-performing loans (NPLs) have soared to Tk1,47,000 crore – 77% of total loans.

This mountain of bad debt has left the banks with a provisioning shortfall of Tk74,501 crore. By institution, Union Bank has the highest rate of default, with 98% of loans classified as non-performing, followed by First Security Islami (96%), Global Islami (95%), Social Islami (62%), and Exim (48%).

To repay depositors, Exim Bank alone has borrowed Tk8,500 crore from the central bank. First Security Islami borrowed Tk7,050 crore, Social Islami Tk6,675 crore, Global Islami Tk2,295 crore, and Union Tk2,400 crore.

Structure of the new bank

According to the central bank’s blueprint, the merged institution will be created under a new name and identity. Once approved by the government, the existing boards of the five banks will be dissolved and replaced with a new state-appointed board.

Initially, the bank will operate under government ownership, with assurances of job security for staff. However, because many branches overlap in the same areas, some employees may be reassigned. In rural areas, new branches may be opened to accommodate them.

The central bank has said the new entity will be overseen by a board of experts in Islamic banking, IT, finance, and law. A managing director with experience in Islamic banking will be appointed.

Governor Ahsan H Mansur recently stated, “Whether the government provides capital as equity or loans, it will be recovered with interest. The government will not bear any losses.”

Under the plan, the new bank will remain under state ownership for three to five years before being gradually privatised. An international company could eventually take ownership, at which point the government expects to recoup its money with profit.

Regaining depositors’ confidence remains the biggest challenge. To support this, the new bank will enjoy special privileges. While Islamic banks are normally required to maintain a 4% cash reserve ratio (CRR) and a 5.5% statutory liquidity ratio (SLR), the new bank will initially be exempt from these requirements.