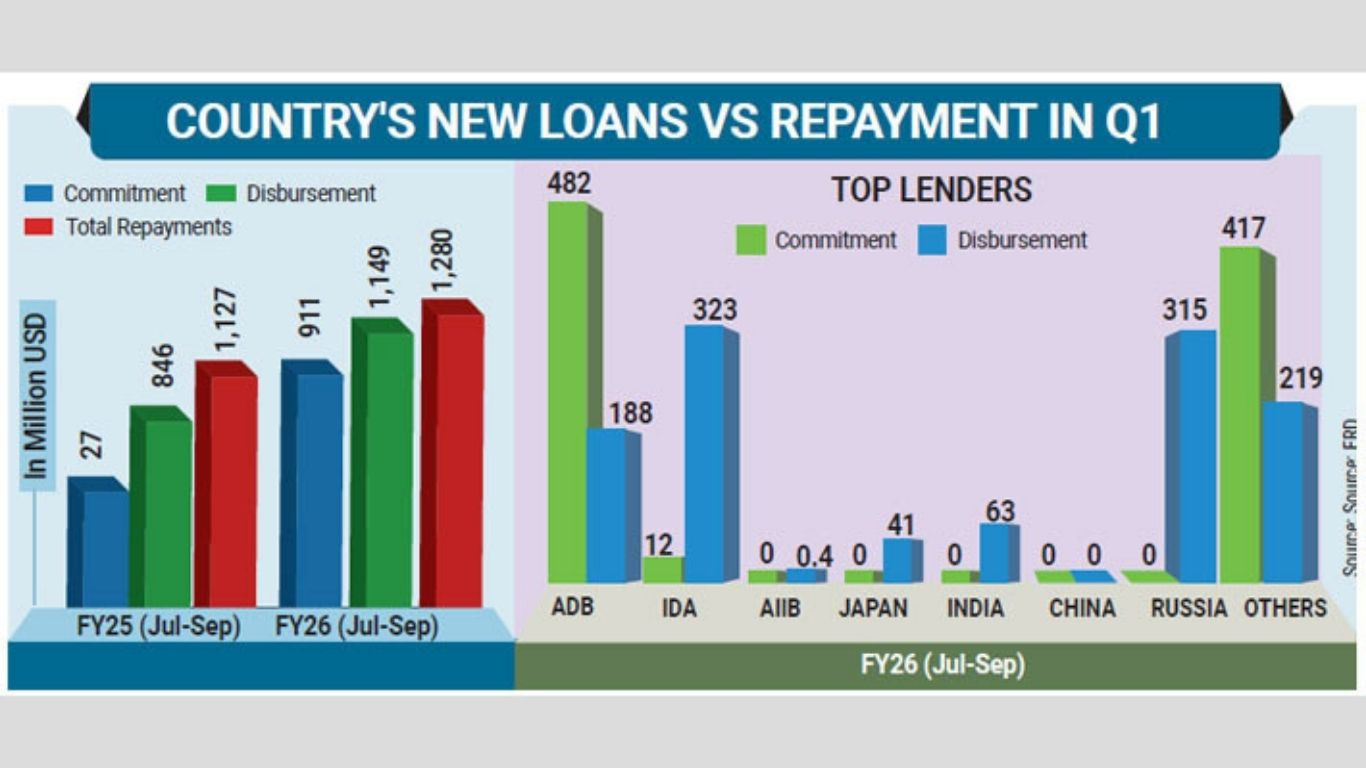

Foreign loan repayments exceeded new disbursements in the first quarter (July-September) of the current fiscal year 2025-26 (FY26), signalling mounting pressure on the country’s external financing position amid slowing project aid inflows and rising debt-servicing costs.

According to the Foreign Assistance Monthly Report (Provisional) issued by the Economic Relations Division (ERD), total loan disbursements during the quarter stood at US$1.04 billion, while repayments, including both principal and interest, reached $1.28 billion, outpacing fresh inflows by over $240 million.

Debt servicing rose sharply by 13.62% year-on-year, totalling $1.28 billion in Q1 FY26 compared to $1.13 billion during the same period last year.

Of this, $816.88 million was paid in principal and $462.96 million in interest.

In local currency, total debt servicing amounted to Tk15,591.69 crore, up from Tk13,412.31 crore a year earlier.

Officials attributed the increase to the maturing of earlier concessional loans and a gradual shift toward costlier bilateral and non-concessional borrowing with higher interest rates and shorter repayment terms.

The Asian Development Bank (ADB) and the International Development Association (IDA) were the two largest sources of foreign aid disbursement during the quarter.

According to the ERD’s Yearly Borrowing Plan FY26, IDA disbursed $322.63 million, followed by Russia with $315.39 million. ADB ranked third with $187.72 million, largely linked to ongoing infrastructure and power projects.

Other development partners included India ($62.83 million), Japan ($40.67 million), AIIB ($0.40 million), and others ($218.95 million). Disbursement from China remained nil during the period, reflecting slower progress on several bilateral projects.

In total, major development partners disbursed $1.15 billion, while new commitments reached $910.67 million, mostly under project assistance. The largest commitments came from ADB ($481.71 million) and other development partners ($416.52 million).

Although aid commitments remain robust, actual fund releases have lagged. Fresh commitments totaled $910.67 million, indicating a strong future aid pipeline but ongoing implementation challenges.

Food aid – once a key component of external assistance – was negligible, with only $10 million disbursed during the quarter.

Analysts warn that the widening gap between repayments and fresh inflows could strain Bangladesh’s balance of payments and foreign exchange reserves if project execution and donor disbursements continue to slow.

“The trend reflects tightening fiscal space and an urgent need to accelerate project execution to sustain foreign funding,” said a senior ERD official.

Dr Mustafa Kamal, executive director of the Institute for Inclusive Finance and Development (INM) and former chief economist of Bangladesh Bank, called the development a sign of structural stress in external debt management.

“When repayments start exceeding inflows, it marks a shift from a borrower’s advantage to a repayment-driven cycle,” Dr Kamal told the Daily Sun.

“Bangladesh must improve the efficiency of foreign-funded projects and diversify exports to maintain external balance. Sustained reforms in fiscal governance and concessional financing are crucial to avoid liquidity pressures.”

With $1.28 billion repaid against $1.04 billion disbursed, Bangladesh effectively became a net payer to foreign creditors in the first quarter of FY26.

Economists say the country’s debt level remains manageable but caution that the window for low-cost financing is narrowing.

“Enhancing project readiness, securing concessional loans, and boosting export earnings will be key to maintaining external stability," one economist noted. “Strong fiscal and project management will be essential to prevent liquidity stress.”

___________________________________________

The reporter can be reached at: [email protected]

Edited by: Anayetur Rahman